1

Post Your Business Opportunities Here / Absolutely Great News for Gold Stock Investor, Abcourt made almost $2 milion.

« on: November 04, 2020, 07:58:01 AM »Absolutely Great News for Gold Stock Investor, Abcourt Mines Made a Whooping Almost $2 Million dollars of Gross Profit

October 30, 2020- Abcourt is pleased to report a Gross Profit of $1,940,767 and a Net Profit of $358,856 for Annual 2020.

Abcourt Mines Inc. reports its results today for the fourth quarter and financial year ended on June 30, 2020.

All amounts are in Canadian dollars unless otherwise indicated.

ABOUT ABCOURT MINES INC.

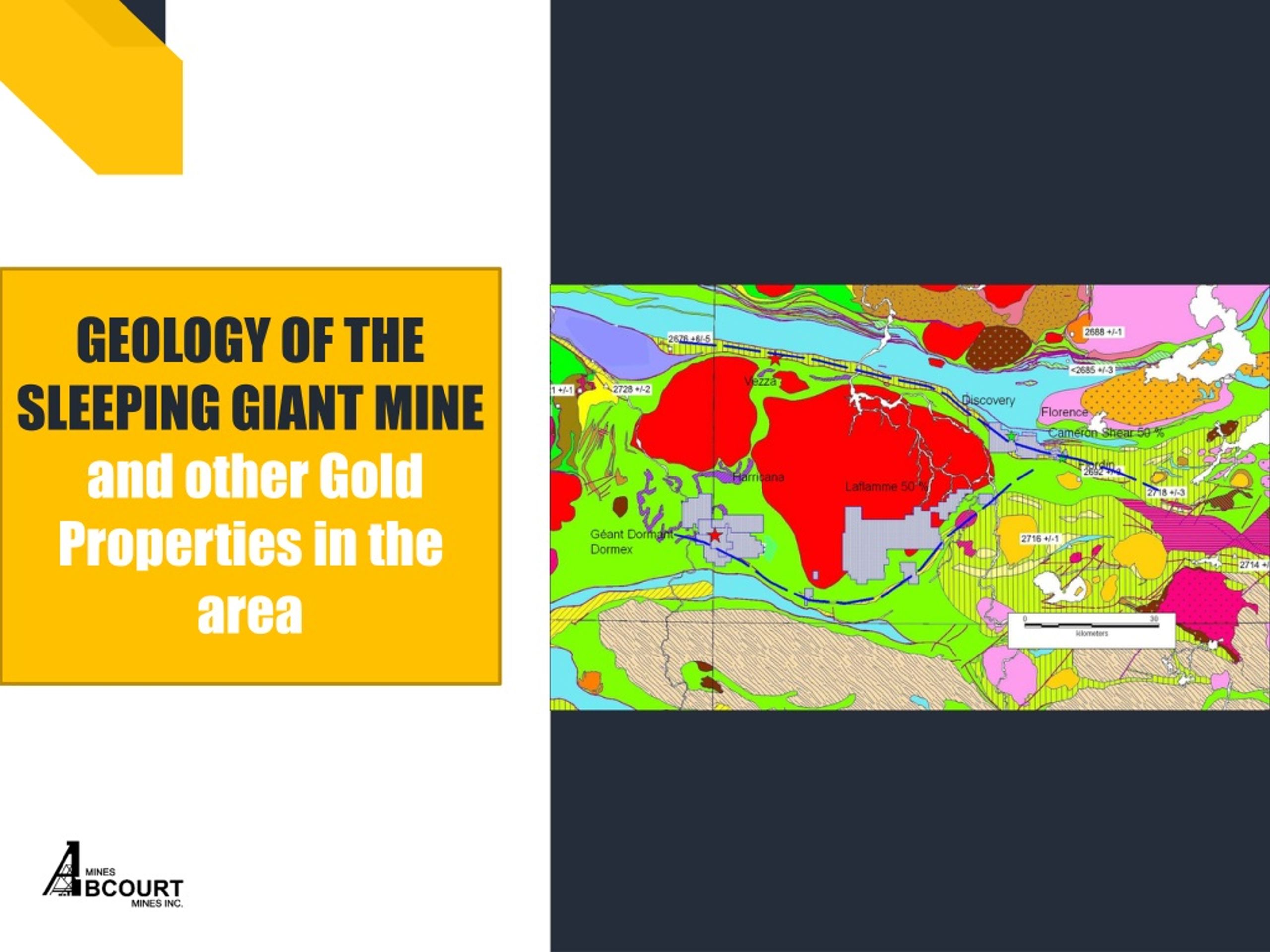

Abcourt Mines Inc. is a gold producer and a Canadian exploration company with strategically located properties in northwestern Quebec, Canada. The Elder property has gold resources (2018). Abcourt is currently focusing on the exploitation of the Elder mine. In 2016, Abcourt acquired the Sleeping Giant mine and mill, located half-way between Amos and Matagami, in Abitibi, Province of Quebec. The mill has a capacity of 700 to 750 tonnes per day. A NI 43-101 resources estimate was filed on SEDAR in May 2019 Measured mineral resources total 10,900 tonnes with a grade of 12.20 g/t of gold and indicated resources total 475,625 tonnes with a grade of 11.20 g/t of gold. Inferred resources are 93,100 tonnes with a grade of 11.85 g/t of gold. A NI 43-101 feasibility study was completed in July 2019 by PRB Mining Services inc. The Abcourt-Barvue property has silver–zinc reserves (2019). A feasibility study was completed in 2007 by Roche / Genivar. An update was completed in January 2019 by PRB Mining Services Inc. A total of 8.07M tonnes are in proven and probable reserves with a grade of 51.79 g/t of silver and 2.83% zinc. About 81.6% of these reserves are mineable by open pit and 18.4% are mineable by underground operation. Inferred resources total 2.07M tonnes with a grade of 114.16g/t of silver and 2.89% zinc. To know more about Abcourt Mines Inc. (TSXV: ABI), please visit our web site at www.abcourt.com and consult our filings under Abcourt’s profile on www.sedar.com. This press release was prepared by Mr. Renaud Hinse, Engineer and President of Abcourt Mines Inc. Mr. Hinse is a “Qualified Person” under the terms of Regulation 43-101. Mr. Hinse has approved the scientific and technical disclosure in this press release.

Highlights:

•Revenues of $24 057 233 for fiscal 2020.

• Gross profit of $ 1 940 767. Net profit of $358,856

• Adjusted net profit of $4,259,151

• Costs of sales reduced by $3,1M or 12.4 %

• Gold inventory of $2,544,974, that is 1,400 ounces

• Cash cost of $1,636 Can/oz, $US 1,228 /oz of gold

• Ounces produced 12,180, sold 11,640

• All-inclusive cost of $1,950 /oz

• Net profit of fourth quarter $ 431 498

• 6 000 Tonnes of broken muck in stopes with an investment value of about $800,000.

• The Company has no long-term debt. It finances itself with its operating revenues.

Recent developments:

• Drifting on 4Th, 10Th and 11Th levels at Elder mine to open new ore zones.

• Rehabilitation work being done in shafts and drifts at Sleeping Giant mine to develop new or zones on upper levels.

• $448,815 raised by the exercise of the 2019 warrants.

• Two explosive permits received for our Sleeping Giant project